Recession in Germany, weak euro area, high interest rates weigh on economies; Visegrád countries weak; Ukraine recovers; arms boom and primitivisation in Russia Putin will unfortunately be able to finance his war of aggression for longer” — Vasily Astrov, economist and Russia expert of wiiw VIENNA, AUSTRIA, October 11, 2023 /EINPresswire.com/ — Despite their previous […]

The post Growth in Eastern Europe under pressure first appeared on Social Gov.

Recession in Germany, weak euro area, high interest rates weigh on economies; Visegrád countries weak; Ukraine recovers; arms boom and primitivisation in Russia

— Vasily Astrov, economist and Russia expert of wiiw

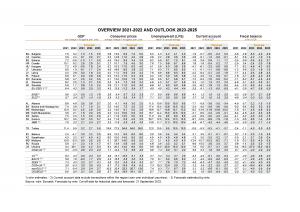

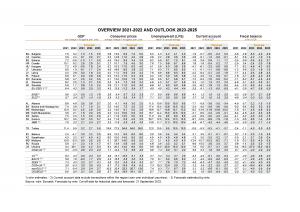

VIENNA, AUSTRIA, October 11, 2023 /EINPresswire.com/ — Despite their previous resilience to the economic consequences of Russia’s war in Ukraine, the economies of Central, Eastern and Southeastern Europe (CESEE) are coming under increasing pressure. That is the finding of the new Autumn Forecast by the Vienna Institute for International Economic Studies (wiiw), which covers the 23 countries of the region. ‘The recession in Germany, a deteriorating international environment, persistently high inflation, monetary tightening and inadequate fiscal policy measures are all weighing on the economy,’ says Branimir Jovanović, economist at wiiw and lead author of the Autumn Forecast.

After an already weak first quarter, growth in some important countries of the region slipped into negative territory in the second quarter: as well as Hungary, by the middle of the year Poland and Czechia, for example, had also contracted. ‘In view of a possible recession across the entire euro area, this negative dynamic could gain momentum, especially in the Visegrád countries, which are closely intertwined with the weakening German industry,’ says Jovanović.

For 2023, wiiw forecasts growth of 0.6% on average for the region’s EU members – similar to the low growth in the euro area (0.5%). This is half the growth rate forecast in the summer. ‘The traditional growth advantage of the Eastern Central Europeans over Western Europe is thus likely to vanish in many countries, at least temporarily,’ claims Jovanović. However, the Southeastern European EU members Romania (2.5%) and Croatia (2.5%) are doing much better: inflows from the EU’s Covid-19 reconstruction fund NextGenerationEU are supporting growth there. The six states of the Western Balkans should grow by 2.1% on average, and Turkey by 3.2%. War-torn Ukraine is likely to see a slight recovery this year, with 3.6% growth, while the aggressor country Russia will expand by 2.3%, thanks to a booming arms industry.

There is light at the end of the tunnel in 2024 for the region’s EU members: wiiw forecasts that next year they will see growth of 2.5% on average, as growth picks up slowly, supported by NextGenerationEU funds. However, there remain significant downside risks. ‘A sharper downturn in the euro area, stubbornly high inflation rates, military escalation in Ukraine or an intensified trade war between the EU and China could jeopardise the recovery next year,’ warns Jovanović. In the medium term, there is thus also the possibility of a stagflation scenario, where the region would barely grow at all, yet at the same time would suffer from high inflation.

Ukraine is starting to recover somewhat

Ukraine’s economy has weathered the Russian invasion better than initially anticipated. For 2023, wiiw is therefore raising its growth forecast to 3.6% of GDP. Despite the Russian Black Sea blockade and the bombardment of grain storage facilities on the Danube river following the end of the Black Sea grain deal, exports of agricultural products rose by 16% from July to August. But the risks are increasing. ‘The import ban slapped on Ukrainian grain by Poland and Hungary is a serious indication of the EU’s growing split on further Ukraine aid,’ says Olga Pindyuk, Ukraine expert at wiiw. ‘But given the high cost of the war, which will result in a budget deficit for Ukraine of 27% of GDP in 2023, any cut in Western aid would be devastating for the country,’ warns Pindyuk.

Russia: There is a primitivisation of the economy, despite the booming defence industry

Despite the current weakness of the rouble and Western sanctions, Russia’s economy is expected to grow by 2.3% this year. ‘The huge increase in military spending is fuelling an arms boom, which – in combination with sharply rising real wages, due to an acute labour shortage – is dragging the economy upwards,’ maintains Vasily Astrov, Russia expert at wiiw. The utilisation of production capacities is at an all-time high, while unemployment is at a record low. In view of the industrial and labour bottlenecks being experienced, the Russian central bank already fears that the economy is overheating: in combination with the weaker rouble, that could fuel inflation. Some sectors affected by the Western sanctions are suffering. So far, however, the sanctions have not hit Russian military production to the extent hoped for.

‘Russia now procures all the high-tech components it needs for its defence industry from the West via third countries,’ says Astrov. However, the sometimes very costly circumvention of sanctions is not enough to supply the rest of the economy adequately with Western high-tech. ‘This will lead to a primitivisation of the Russian economy. Together with the ever-increasing addiction to rising defence spending, this is also likely to severely limit growth prospects in the medium term.’ However, the budget deficit of 2.5% of GDP for this year, resulting from the high costs of the war, seems bearable to Astrov: ‘Putin will unfortunately be able to finance his war of aggression for longer.’

Despite stubbornly high inflation, real wages are rising in large swathes of the region

Even though inflation has passed its peak in practically all the countries observed, it is likely to remain high for the foreseeable future. The main driver of inflation is rising food prices, which are creating ever-greater social problems. However, core inflation (excluding food and energy) now exceeds headline inflation in most countries of the region. While corporate profits are at a historically high level, real wages are also picking up for the first time in a while. If companies were to respond to this with further price rises, that could lead to an entrenchment of inflation.

Andreas Knapp – Communications Manager

Vienna Institute for International Economic Studies (wiiw)

+43 680 1342785

[email protected]

Visit us on social media:

Twitter

LinkedIn

YouTube

Other

![]()

Article originally published on www.einpresswire.com as Growth in Eastern Europe under pressure

The post Growth in Eastern Europe under pressure first appeared on Social Gov.

originally published at Global News - Social Gov

,

,